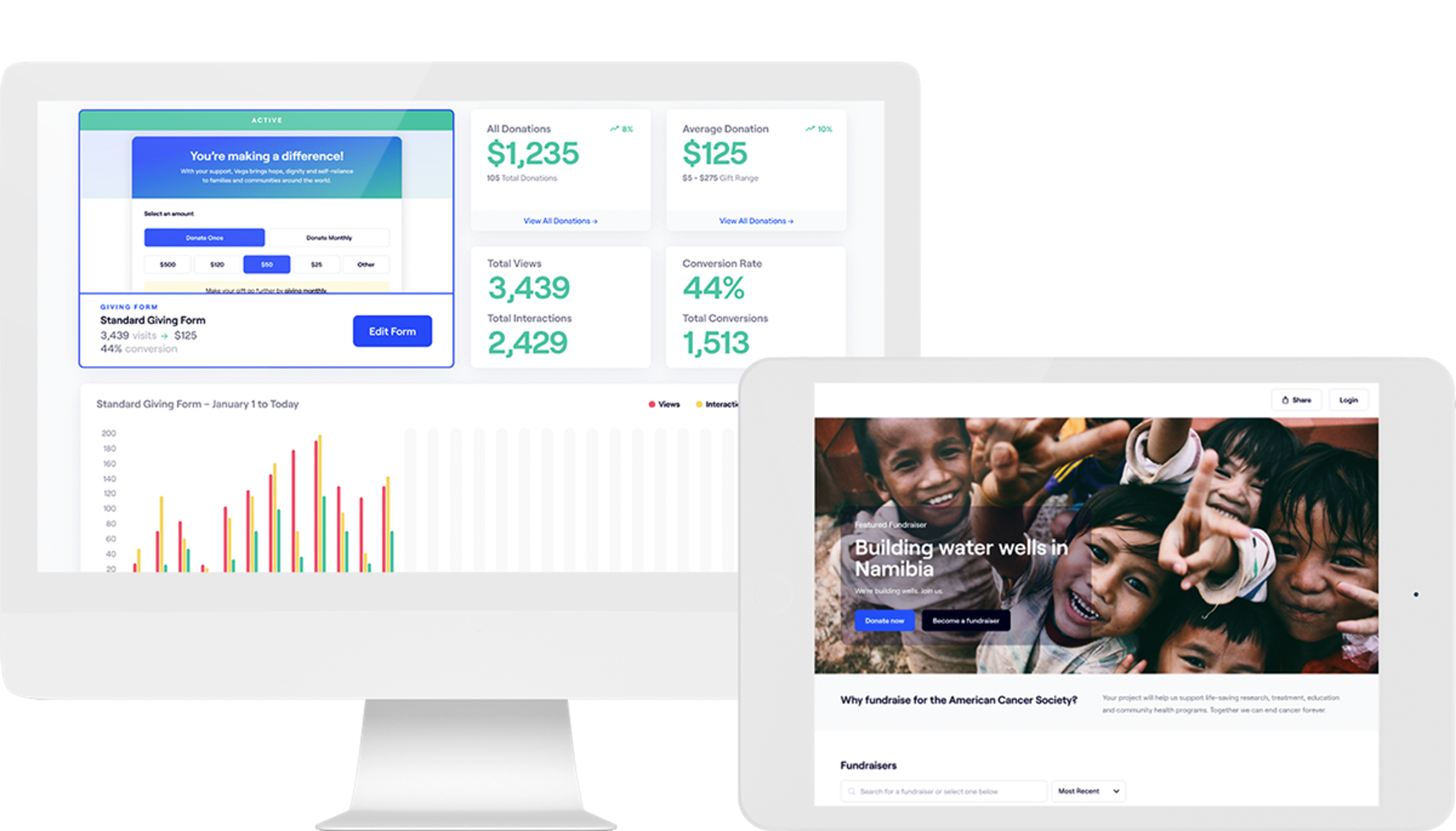

Unified Back Office

Deploy, manage, analyze, and report on all your church’s giving activity in one easy-to-use online back office.

Generosity is a spiritual character trait fostered by church leadership, teaching, discipleship, and sharing of motivational content …. and the implementation of effective digital giving programs that make it easy and convenient for a giver to give once for a need, or perhaps more importantly, to tithe regularly.

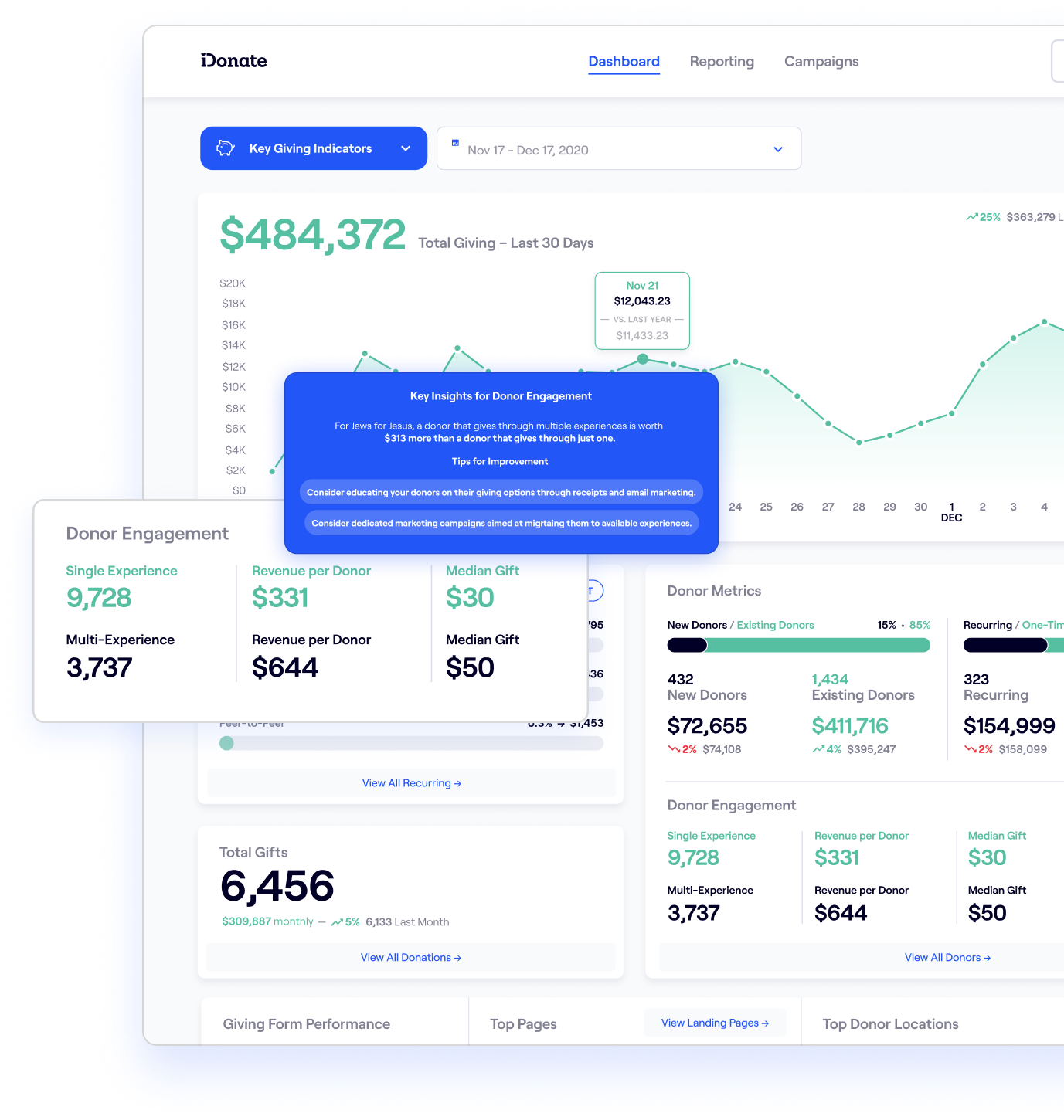

Despite the challenges of 2020 and 2021, customers of iDonate's Generosity platform grew online giving adoption rapidly by using simple but effective online giving tools.

As church leaders encourage their memberships to adopt generosity as a biblical and spiritual lifestyle, iDonate's Generosity platform makes it easy for them to get started and create impact.

![]()

Deploy, manage, analyze, and report on all your church’s giving activity in one easy-to-use online back office.

Your givers can manage recurring gifts, review past gifts, print tax statements, and more.

![]()

Have a church app already? Great! We integrate with a variety of church management software platforms to help you stay connected to your givers.

![]()

Add our giving form right on your website, blog, or even Facebook page with your church’s look and voice in a few simple steps.

![]()

90% of the general public can send and receive text messages, and most text messages are read within three seconds of receiving them. Improve engagement with your donors by allowing them to quickly and easily respond to any fundraising need.

![]()

Give cars, jewelry, stocks, property, and more. We liquidate the items for you and send your church cash.

![]()

Create, host, and promote your own fundraising event. It’s easy to set up a custom event page, sell tickets, survey attendees, and much more.

![]()

Your people are your best champions, so why not unleash them? We provide a simple way for your givers to set up and manage their campaigns for causes your church is passionate about — all within a branded, easy-to-use set of pages you can control.

Convenience is not enough. New research* shows that 74% of churches offer online giving, but only 15% of donations are given online.

Generosity powered by iDonate is built to bridge this gap by focusing on transformation, not just the transaction. The innovative backoffice gives you total control over how your church gives. Embed custom giving forms on any web page for everything from regular tithing to student camp or mission trip sponsorships.

*2018, Dunham+Company/Campbell Rinker